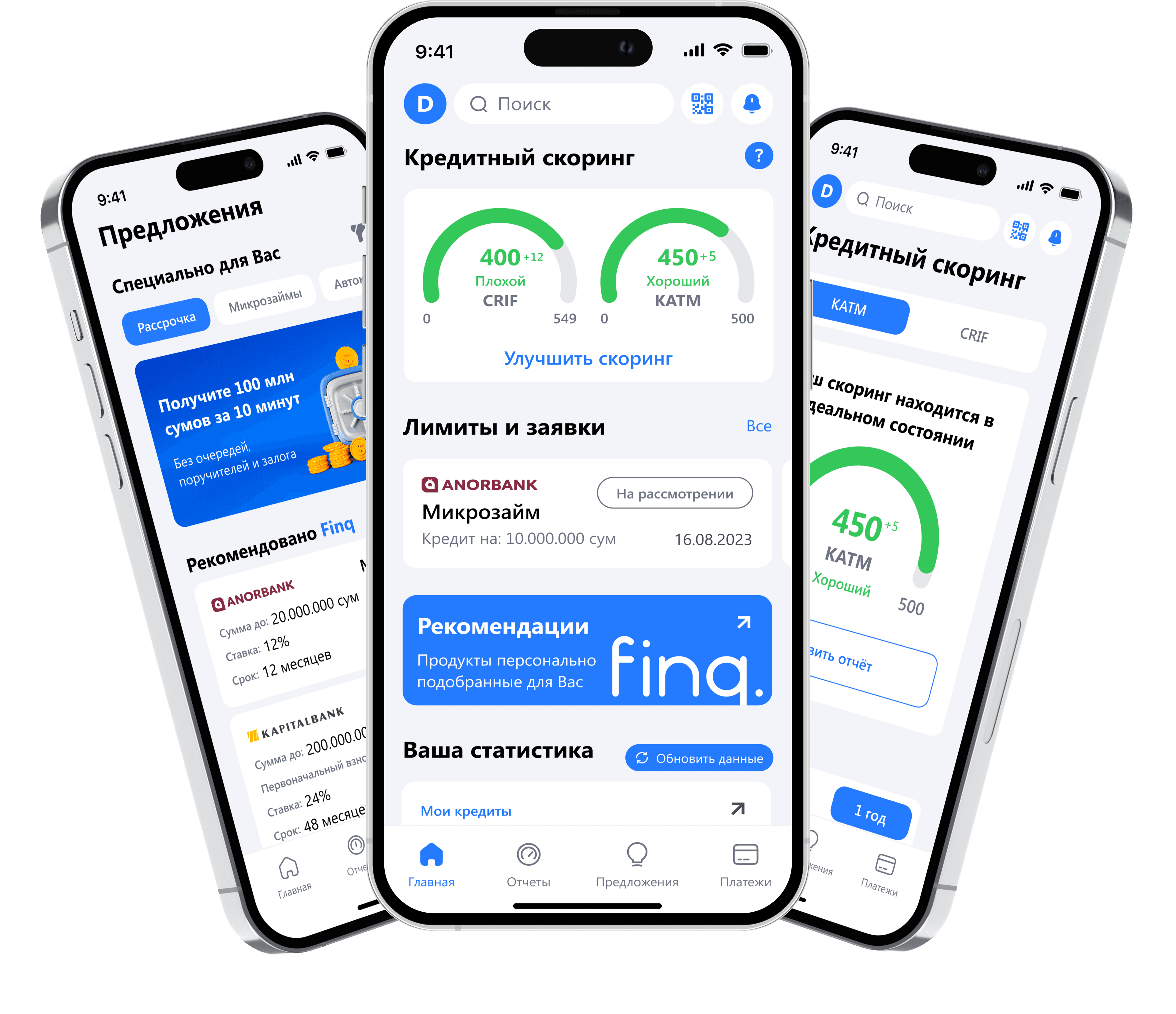

FINQ FINANCEin your hands

Monitor your credit score and manage your finances wisely with FINQ

Personal guide tofinance and loans

Discover the world of financial opportunity with FINQ, where your credit score is the key to great deals

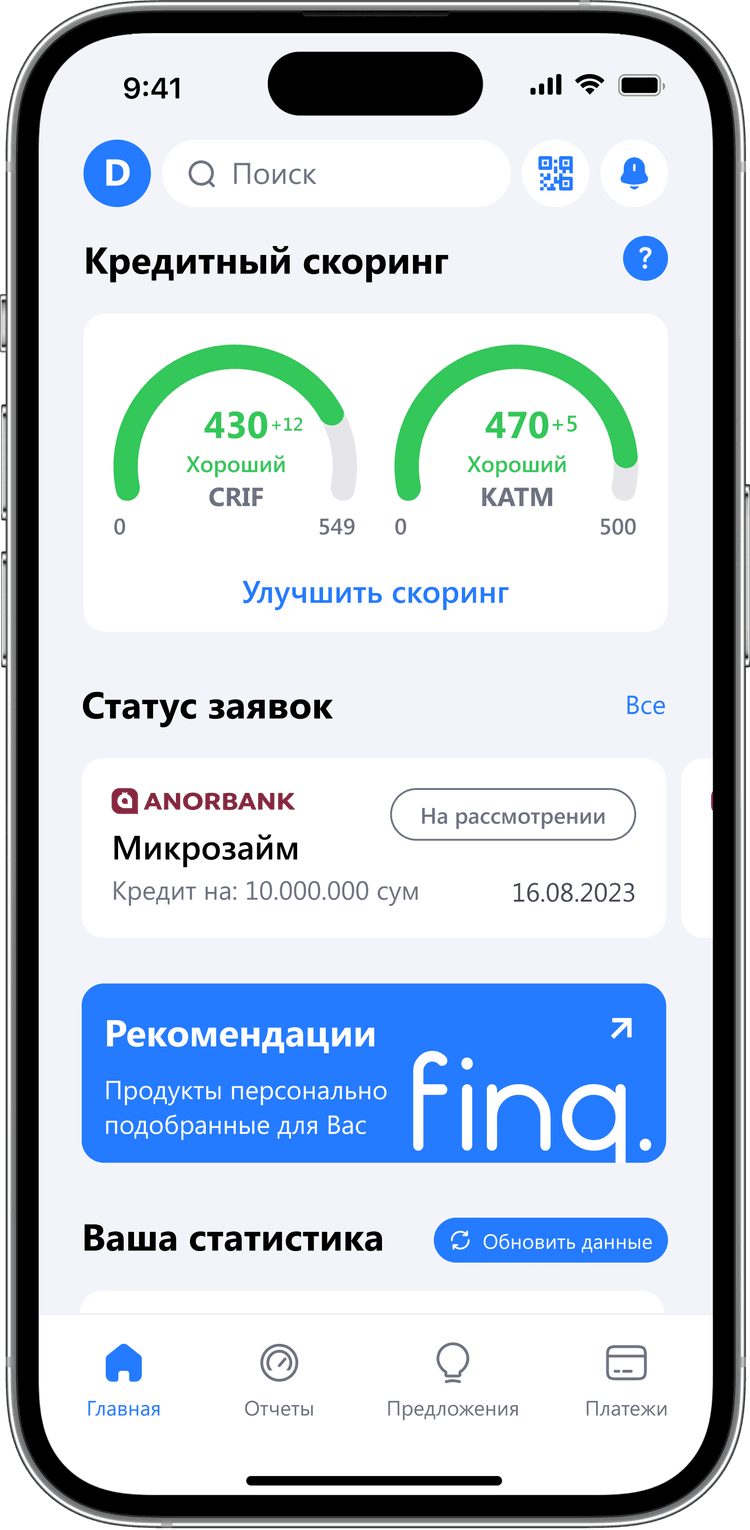

Scoring

Your personal scoring in the mobile app

Customized Products

List of products that are selected specifically for you

Credit rating

Checking your credit rating and helping you improve it

Credit monitoring

Full access and monitoring of all loans that you have

Support

We are in touch 24/7 and always ready to help

Keep your finances always at hand

Discover the world of financial opportunity with FINQ, where your credit score is the key to great deals

Statistics

All the necessary information and statistics are always at handIndividual selection

Selection of products and loans according to your credit ratingReports

Current reports on all credit transactions

Frequently asked

questions

Discover the world of financial opportunity with FINQ, where your credit score is the key to great deals

What is a credit rating?

A credit rating is an assessment of the borrower’s creditworthiness, based on his credit history, average monthly income, debt on the Enforcement bureau and other personal data (for example, age, marital status, etc.). It is a reflection of your chances of getting a new loan. The higher the rating, the easier it is for you to get a loan on better terms.

Why do you need a credit rating?

Having received a credit rating, you can get a quick overview of your credit history, see how banks evaluate it and assess your chances of getting a loan. After calculating your credit rating, only those banks that are ready to issue you a loan will be selected for you.

How does our service work?

You provide your personal data and undergo identification. We calculate your credit rating and select individual loan offers, as well as select loan offers from banks where you have the maximum chance of getting a loan.